It is an exciting time for FinTech ventures in Colombia and across Latin America. Capital investments into startups have hit record levels. Avid entrepreneurs and talented young leaders are developing innovative business solutions fitted to our complex geopolitical context-specific problems. And throughout the wired mobile ecosystem tech-enablers are empowering users, citizens and consumers with the financial tools of the future.

FinTech startups are undoubtedly vital for Colombia, Latin American economies, and the wider global financial ecosystem. Innovative FinTech products and services might allow not only for greater financial inclusion to flourish by connecting mobile users to well-suited solutions; but also access to better insurance programs and even health services, secure passage to asset investment, and greater competition among traditional payment and banking methods.

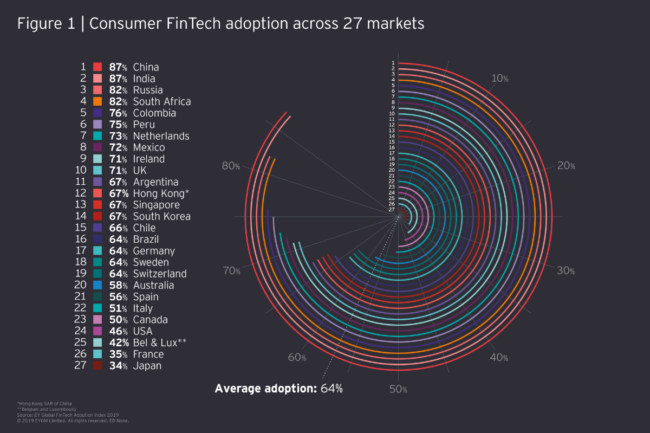

Source: EY (2019)

Tech-enablers are empowering users, citizens, and consumers with the financial tools of the future.

FinTech Diffusion in Colombia

Data from the EY Global FinTech Adoption Index (2019) which measures the penetration of FinTech worldwide places Colombia in fifth place (5th) with an adoption rate of 76%. This sets the South American country amongst the leaders in FinTech adoption worldwide and sitting well above the global adoption average of 64% just behind China (87%), India (87%), Russia (82%) and South Africa (82%), and ahead of markets as strong as Japan (34%), Canada (50%), the United Kingdom (71%) and Singapore (68%).

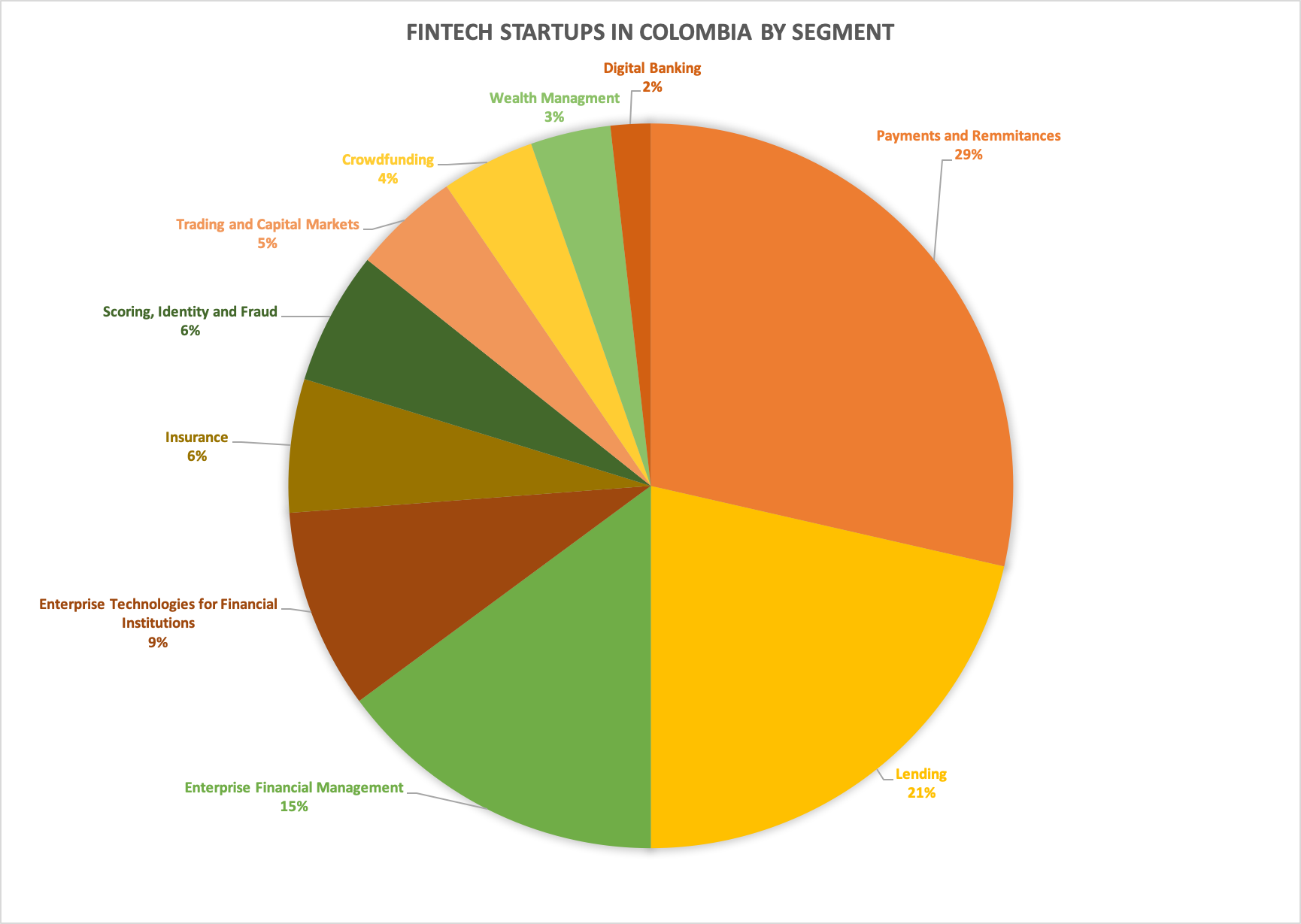

Self-Elaboration with Data by Finnovista (2019)

According to the latest figures by Finnovista (2019), Colombia reinforced its position as the third (3rd) largest FinTech ecosystem in Latin America just after Brazil (377) and Mexico (334) reaching a total of 180 startups with a total of 180 startups (with 78 new ventures emerging in less than two years). The leading segments empowering Colombia’s FinTech growth were payments and remittances (27%), lending (20%), enterprise financial management (14%), enterprise technologies for financial institutions (8%), insurance (5.50%), and scoring, identity and fraud (5.50%). The outstanding segments were trading and capital markets (4%), crowdfunding (4%), wealth management (3%) and digital banking (2%). This allows us to evidence improvements within several FinTech verticals and confirms the continuous inclusion of brand-new players committed to multiple specialties within the applied financial technologies’ spectrum. Indeed, according to Colombia Fintech, estimations are that today there might be nearly 220 FinTech startups operating within the country. These enterprises are established in cities like Bogota, Medellin, Cali, Barranquilla and Manizales providing financial access for unbanked and underserved consumers and SMEs, as well as already banked SMEs or individuals interested in new tech-based finance solutions, and providing innovative services for businesses, corporations and financial institutions.

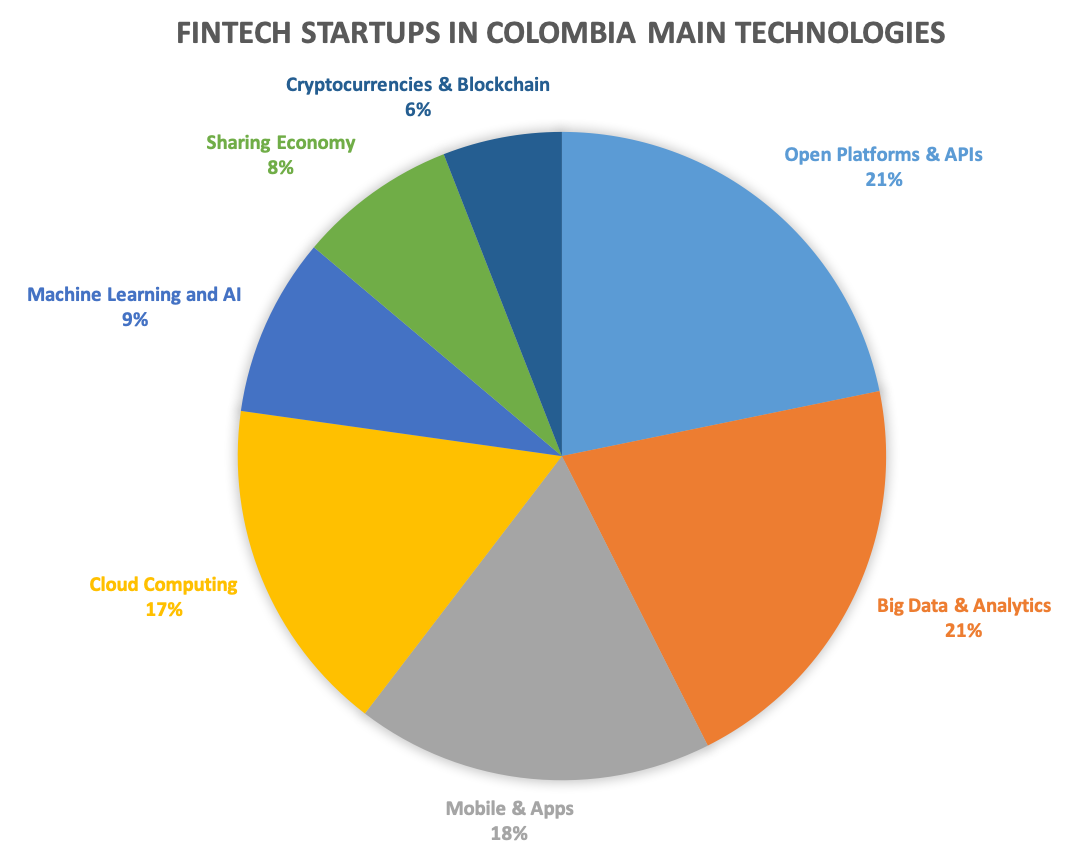

According to Finnovista, the main technologies being deployed by Colombian FinTechs were APIs and open platforms (22%), Big Data and analytics (21%), mobile and applications (18%), Cloud Computing (17%), Machine Learning and AI (9%), sharing economy (8%), and Blockchain and cryptocurrencies (6%).

Self-Elaboration with Data by Finnovista (2019)

Colombia Fintech estimates that today, there might be nearly 220 FinTech startups operating within the Colombian financial services ecosystem. These enterprises are established in cities like Bogota, Medellin, Cali, Barranquilla and Manizales providing financial access for unbanked and underserved consumers and SMEs, as well as already banked SMEs or individuals interested in new tech-based finance solutions, and providing innovative services for businesses, corporations and financial institutions.

According to Finnovista, the main technologies being deployed by FinTechs in Colombia are Open Platforms and APIs (22%), Data and Analytics (21%), Mobile and Applications (18%), Cloud Computing (17%), Machine Learning and Artificial Intelligence (9%), Sharing Economy (8%), and Blockchain and Cryptocurrencies (6%). A recent survey carried out by the Financial Superintendence of Colombia (SFC), identified Big Data and Analytics, Blockchain, Biometrics, Cloud and Cognitive Computing as the technologies with the most potential for disruption in the coming years while pointing out to the most pressing challenges for the country including the protection of personal data and information, cybersecurity, consumer protection, money laundering and balanced market competition. This demonstrates the importance of concise data protection regulation(s) while the mixture of policies and human inventiveness will set the debate for years to come.

What the future holds: regulation and collaboration

In the last few years, the Colombian government has taken important steps towards strengthening the FinTech ecosystem. The country has moved forward in terms of a comprehensive financial inclusion strategy and has approved segment-specific regulation for initiatives like the specialized electronic payments and deposit societies (SEDPEs), crowdfunding, and enabling financial institutions to invest in ventures related to innovation and financial technology. The country’s Financial Superintendence has also opened up spaces and mechanisms for innovation and experimentation such as the InnovaSFC hub, sandbox and RegTech space. It is relevant here to highlight the importance of advancing open banking infrastructure for enabling the interconnection between different entities and traditional financial institutions. This allows companies to leverage extensive amounts of data and information while opening-up bridges for technological innovation, alternative financial data models, new risk assessment systems, deeper inter-institutional collaboration and improved consumer service.

The future for FinTech startups in Colombia looks quite bright with experienced FinTech experts like a16z investing directly in local startups and established regional financial players like Credicorp entering the field and setting up tech-ventures. Many other important institutions such as the IADB are supporting FinTech at the regional level. For 2020, the country is expected to see closer collaboration between financial entities and startups, acceleration of the transition into digital payment forms, and further disruption of traditional financial services by technology-related innovation.