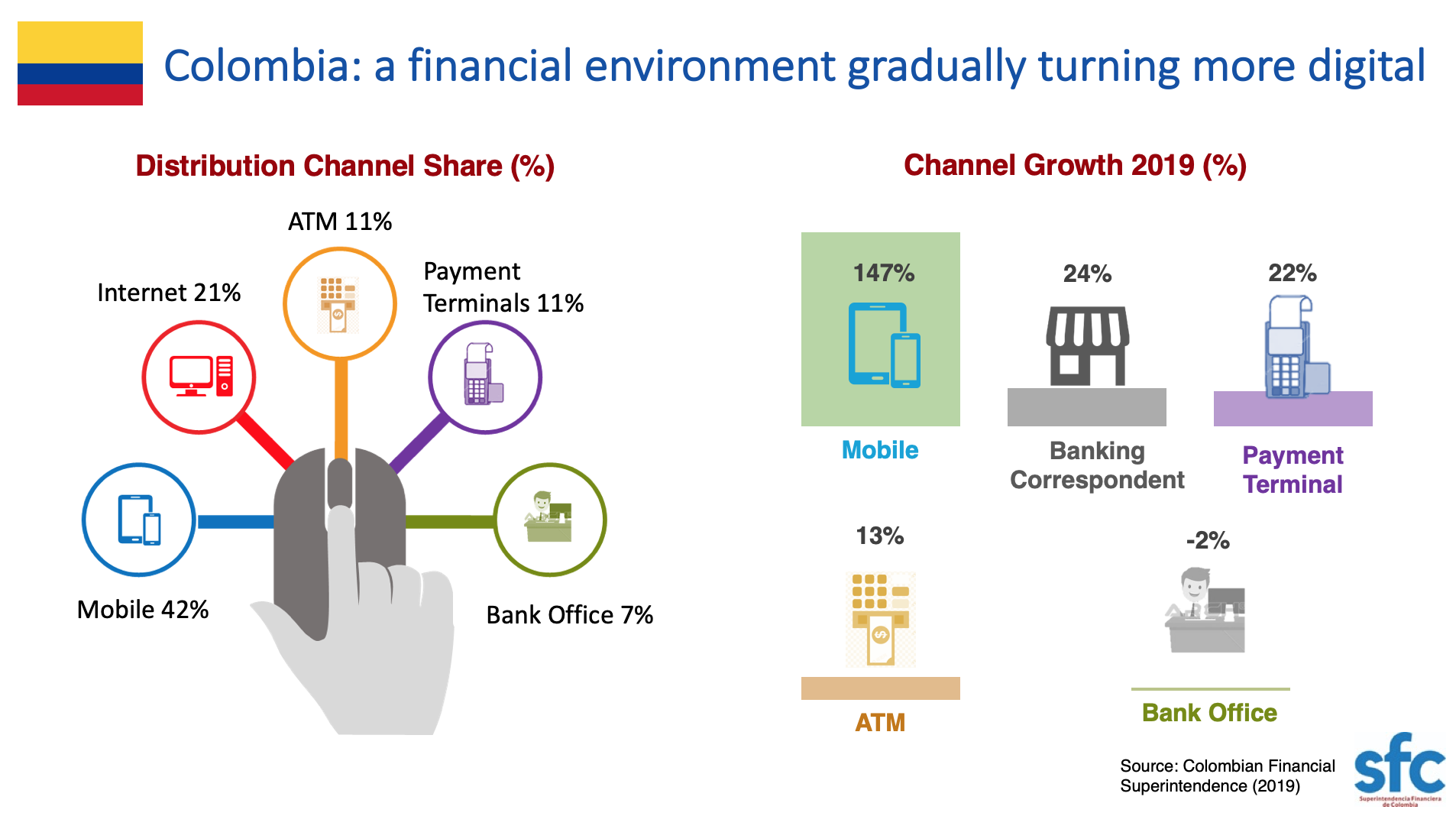

The Colombian financial sector is extremely dynamic and evolving rapidly. Institutions have set up the proper administrative and regulatory framework for encouraging innovation in financial products and services through the use of new technologies. Banks are running to catch-up on digital channels, consumer experience and service personalization. And meanwhile, FinTechs have gained track within the local ecosystem, setting up the bar for active entrepreneurship and propelling a dynamic force for delivering much-needed solutions to different types of consumers all across the national territory.

Taking Colombia’s Regulation Into Account

Colombia has quietly and modestly advanced in FinTech supervision and regulation with efforts aimed at promoting the use of digital financial technologies and their application for developing alternative finance solutions. Colombia is also the global leader in financial inclusion policy (we will be diving into that on our next post).

This week we want to introduce you to the Colombian FinTech ecosystem taking a look at the main entities in charge of financial supervision and regulation in the country. We had already mentioned on our latest post the creation of InnovaSFC by the Financial Superintendence of Colombia.

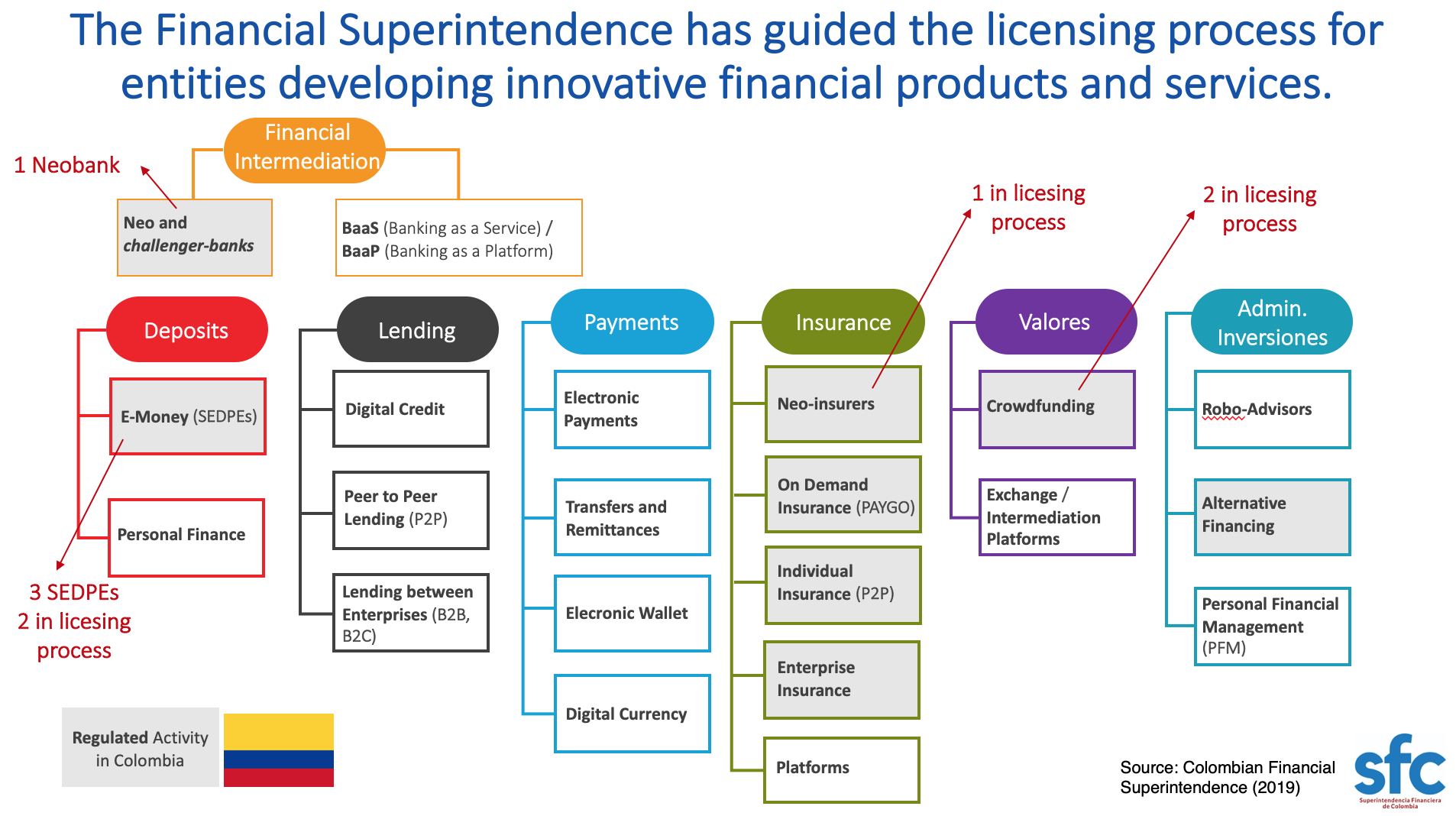

InnovaSFC was born as a special space within the financial and banking superintendency to support, guide and accompany technological developments for the financial industry. Through its mechanisms, startups interested in entering the fintech environment can contact and apply to be made eligible for progressively testing their products and services. InnovaSFC has set up a hub, a sandbox, and a RegTech space. After a successful trial period, FinTechs then become licensed to operate under the regulation and supervision of the Financial Superintendency.

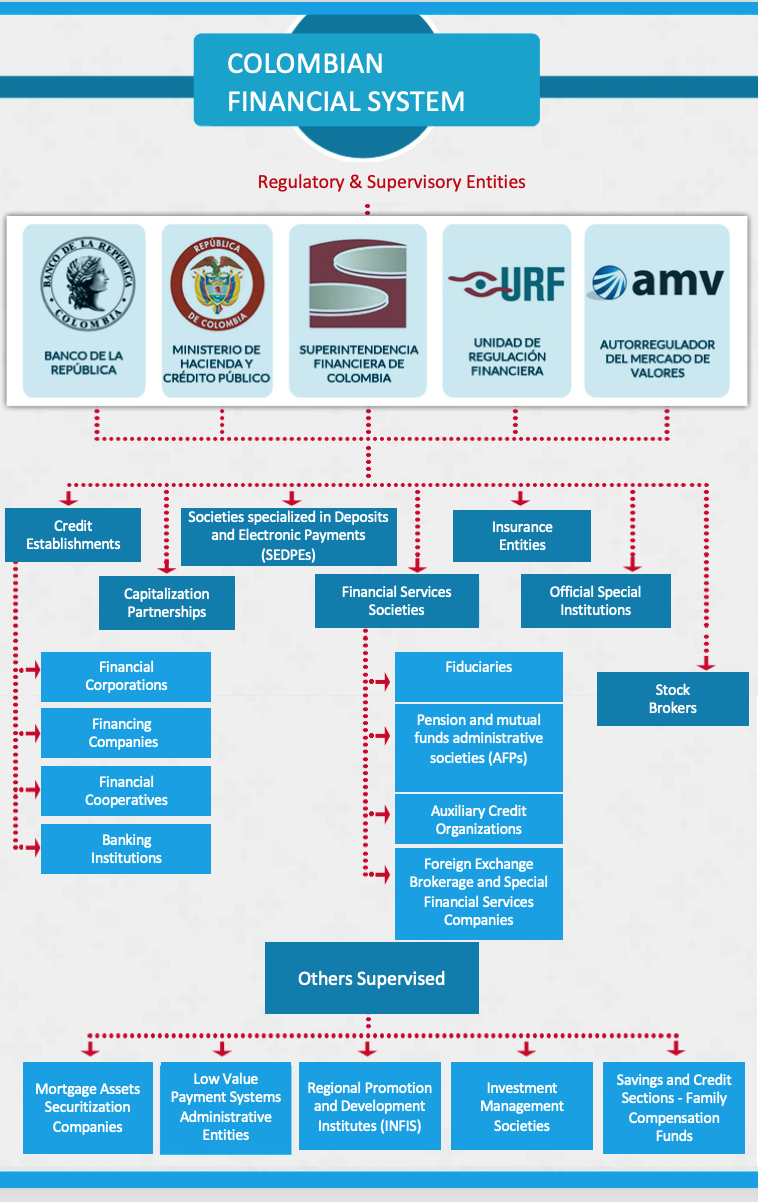

It is also notable that Colombia, through the initiative of institutions such as the Ministry of Finance and Public Credit [Ministerio de Hacienda y Crédito Público], the Financial Regulatory Unit [Unidad de Regulación Financiera] and the Financial Superintendence, has promoted responsible innovation within the national financial ecosystem. Until today, Colombian policymakers have propelled the approval of various legislative pieces related to innovation and financial technologies and being deployed gradually without compiling everything into an overarching “FinTech law” like in Mexico. These legislative system has proven effective for the proper evolution of the FinTech environment within the country and has contributed significantly to facilitate and promote the application of technology innovation into finance.

This way, the Colombian authorities have managed the evolution process of FinTech within the country, promoting the use and application of technologies within finance, and disposing of the proper framework for the adoption of technologies within various finance fields.

“Colombian Institutions have set up the proper administrative and regulatory framework for encouraging innovation in financial products and services”.

FinTech Regulation: Work in Progress

During past years, Colombia established Law 1735 of 2014 enacted by Decree 1491 of 2015, enabling the creation of the “Specialized Societies for Electronic Deposit and Payments” (SEDPEs) [according to the Spanish acronym for Sociedades Especializadas en Depósitos y Pagos Electrónicos], promoting the emergence of a more robust digital transaction environment. Currently, there are around 3 SEDPEs operating under the supervision of the Financial Superintendence and 2 under the licensing process, including national pioneer Movii, offering completely free of charge deposit and holding of funds for people without access to traditional banking services and consumers looking for a different banking experience. Movii works via mobile app and users can have access to their funds directly through a debit card.

Colombia also opened up the space for use of modern technology-based tools within the securities market, with Decree 661 of 2018. This piece of legislation supports the use of innovative tools for financial investment advisory, trading and capital markets. In 2018, the country also organized an act for crowdfunding and collaborative finance platforms (Decree 1357 of 2018) and Decree 2443 of 2018 enabling investment from traditional financial institutions in FinTech enterprises and setting up the ground for collaboration and partnerships between FinTechs and established financial institutions.

Additionally, Colombia is structuring additional legislation intended to include new players, models and infrastructure for the financial system and aimed at allowing financial access for a wider set of the population in need of basic financial services. The is already a draft ready for this legislation which you can access through Colombia Fintech. The proposed bill is intended to address digital and inclusive channels and products intervening matters related to correspondents, electronic savings accounts, electronic deposits, micro-credits, and several other provisions.

This reaffirms Colombia’s government commitment to extend its citizens’ ubiquitous access to financial services through financial inclusion policies, strategies and programs, and is also in line with the country’s engagement in making digital and web access available across the national territory.