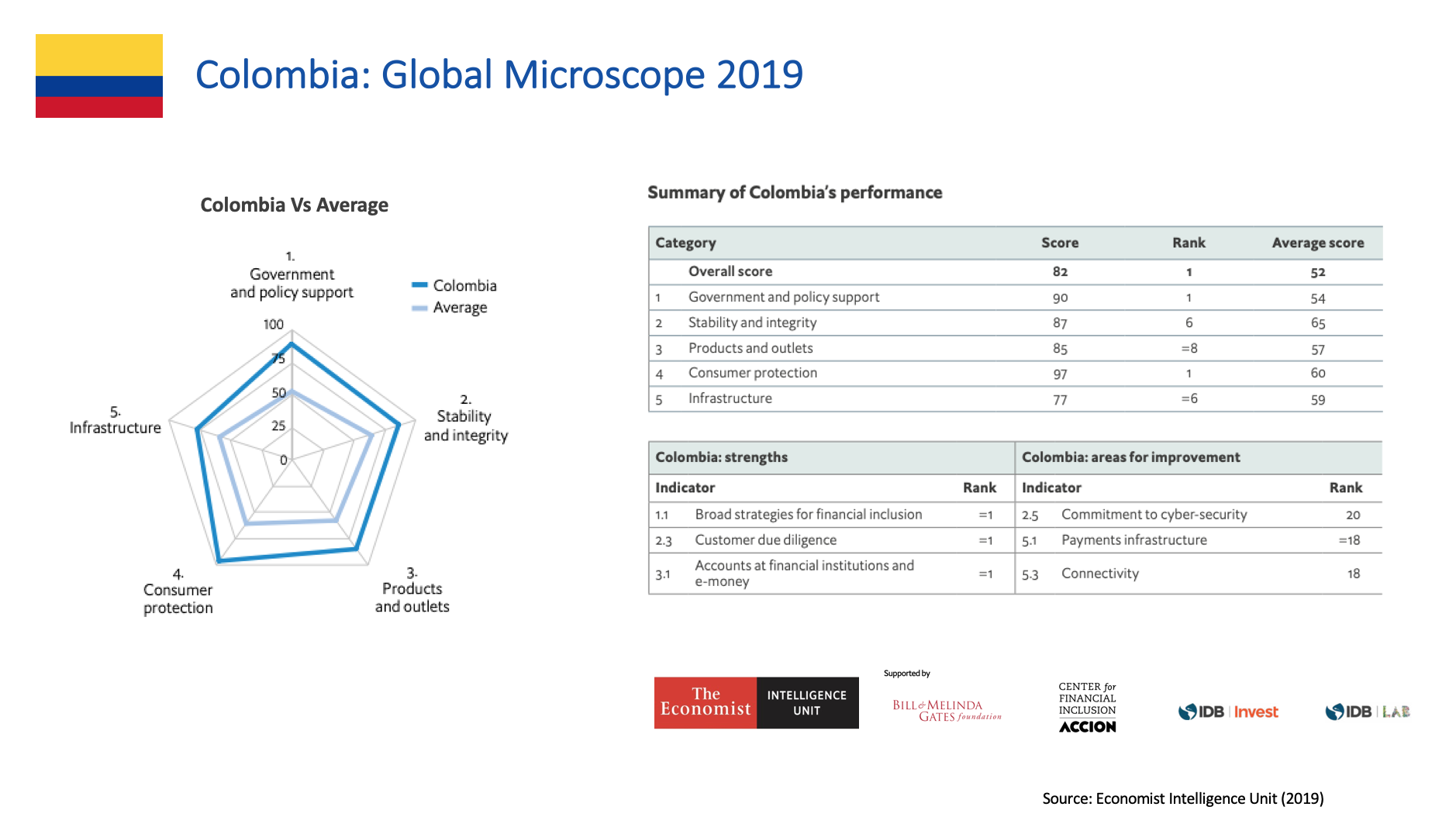

According to the Global Microscope (2019), a study that analyzes the practices used by governments and regulators around the world to increase financial inclusion, Colombia is the leader among 55 national economies. Developed by the Economist Intelligence Unit (EIU) with support of the Gates Foundation, the Center for Financial Inclusion at Accion, IDB Invest and IDB Lab, the report provides detailed up-to-date information on financial inclusion for many countries around the world, and highlights the initiatives being implemented by global leaders across all continents, allowing to compare the diverse approaches taken worldwide to tackle this complex and pressing issue.

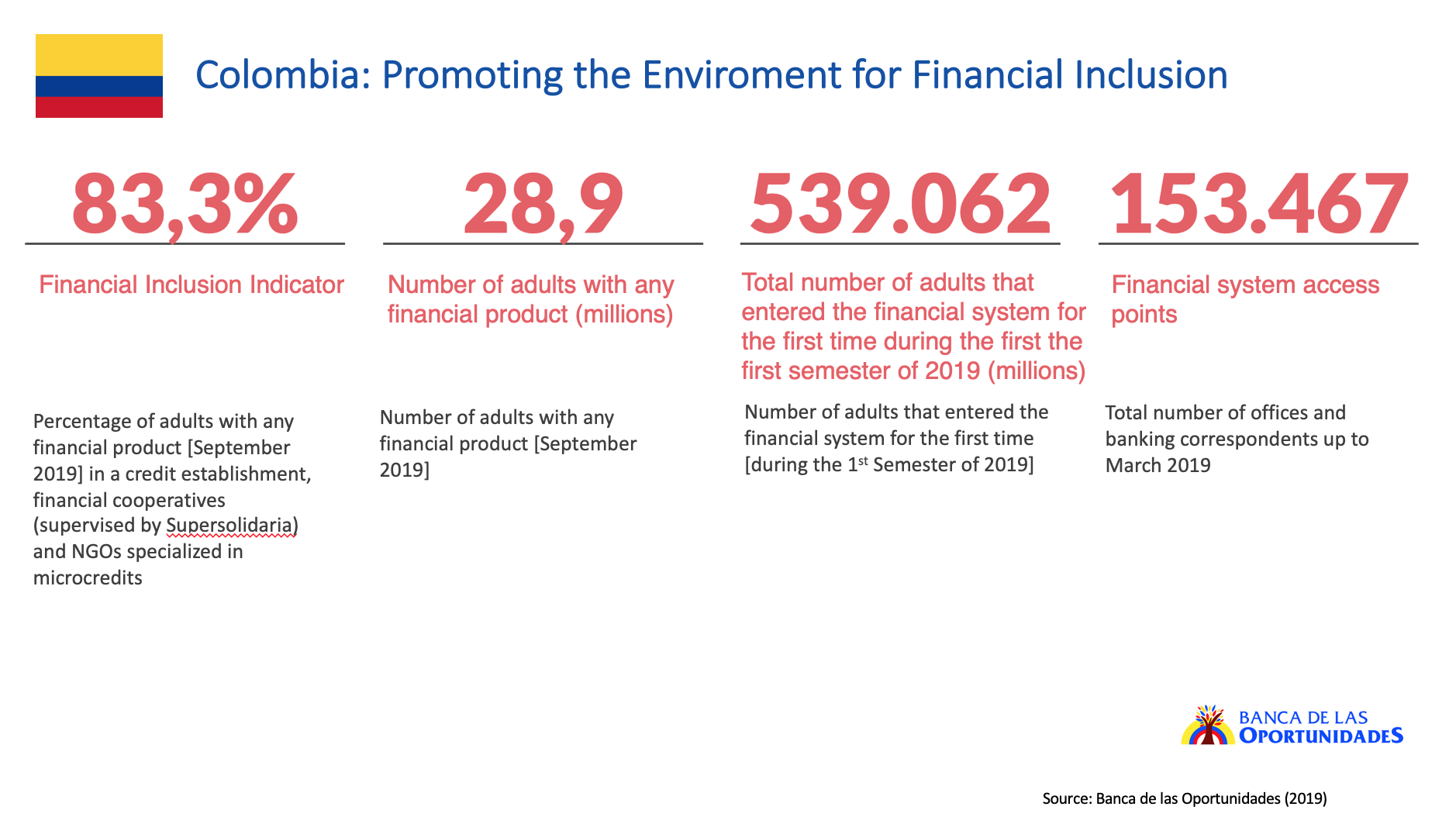

Colombia: Promoting an Environment for Financial Inclusion

Diving into Colombia’s figures, the Global Microscope points out several success factors including the existence of a broad interinstitutional strategy for financial inclusion, successful levels of customer due diligence, and also the recent approval of a regulatory sandbox to assist rapid and safe testing innovations in finance, with legislative pieces on crowdfunding and opening up banks ability to invest in the financial technology sector. Colombia’s main challenges remain to strengthen a commitment to cybersecurity, develop and evolve the payments infrastructure, and heighten internet connectivity across the national territory.

Colombia’s government has recognized the power of providing citizens with access to finance and the significant role played by technological and digital solutions helping democratize access to financial products and services. In 2014, the Colombian government framed its National Strategy for Financial Inclusion, and Decree 2338 of 2015 established the Intersectoral Commission for Financial Inclusion (CIIF) as an instance for inter-institutional cooperation between numerous relevant entities including, key ministries, the regulatory bodies, and with the permanent participation of several other important institutions such as Banco de la República (Colombia’s Central Bank), Banca de las Oportunidades (directed by Bancoldex), the Agri-Sector Finance Fund (FINAGRO), and Banco Agrario among others. The Commission is also joined by a consultative committee composed of both public and private institutions including AsoBancaria (Banking and Financial Entities Association), AsoMovíl (Mobile Tele-Communications Association), AsoMicroFinanzas (Association of MicroFinance Institutions) and the Colombian Chamber of Electronic Commerce and representatives from the agricultural sector.

Colombia’s government has recognized the power of providing citizens with access to finance and the significant role played by technological and digital solutions helping democratize access to financial products and services. In 2014, the Colombian government framed its National Strategy for Financial Inclusion, and Decree 2338 of 2015 established the Intersectoral Commission for Financial Inclusion (CIIF) as an instance for inter-institutional cooperation between numerous relevant entities including, key ministries, the regulatory bodies, and with the permanent participation of several other important institutions such as Banco de la República (Colombia’s Central Bank), Banca de las Oportunidades (directed by Bancoldex), the Agri-Sector Finance Fund (FINAGRO), and Banco Agrario among others. The Commission is also joined by a consultative committee composed of both public and private institutions including AsoBancaria (Banking and Financial Entities Association), AsoMovíl (Mobile Tele-Communications Association), AsoMicroFinanzas (Association of MicroFinance Institutions) and the Colombian Chamber of Electronic Commerce and representatives from the agricultural sector.

The National Strategy for Financial Inclusion is primarily focused on increasing the population’s access to the banking system, increasing the use of financial products and services, and improving financial literacy. What is also interesting about Colombia’s policy is that from the beginning, technology has played a critical role in advancing innovative solutions for citizens in an effort to reduce the heavy use of cash and increase the populations’ access to credit and other important products.

The National Strategy for Financial Inclusion is primarily focused on increasing the population’s access to the banking system, increasing the use of financial products and services, and improving financial literacy. What is also interesting about Colombia’s policy is that from the beginning, technology has played a critical role in advancing innovative solutions for citizens in an effort to reduce the heavy use of cash and increase the populations’ access to credit and other important products.

Decree 1735 of 2014 gave way to the creation of SEDPE(s) (Spanish acronym for Sociedades Especializadas en Depósitos y Pagos Electrónicos). The legislation authorized the creation of these unique entities to provide electronic deposit and payment solutions for consumers and SMEs without access to basic banking products and services. These institutions, such as pioneer Movii, Coink or Powwi, provide users with access to transactional financial services such as payments (public services, internet, e-commerce, etc), transfers, and collections by digital means in order to strengthen financial inclusion indexes for both people and businesses.

The main characteristic of electronic deposits is their simplified opening plus KYC (know your customer) procedures where only ID and cell-phone are required. SEDPEs are subject to the inspection, surveillance, and control of the Financial Superintendence and were created with minimum capital requirements lower than those of banks so that they remain exclusively dedicated to the issue of electronic deposits and payments.

Regulation for Financial Inclusion

Nevertheless, recently approved legislation as opened all regulated institutions that usually work with microcredit (such as SEDPEs, cooperatives, and banking correspondents), to grant loans of up to four legal minimum wages to people without a credit history. In fact, Colombia’s most recent legislative piece, Decree 222 of 2020 aims to allow the population with no previous access to basic financial products and services to enter the financial system through electronic deposits accounts that function without minimum amounts and mostly at cero fees, and through which they can have access to digital payment methods, transfers and now access to microcredit loans based on alternative data.

FinTech Solutions Enable Easy and Convenient Access to Regulated Financial Services

In a country where traditional financial services have been characterized as inefficient, with large barriers to entry and very expensive, the outstanding potential for financial inclusion remains tremendous. According to a study, the country has the opportunity to generate US$13.800 million by focusing on increasing the indicator. FinTechs such as Tpaga enables users to receive funds via mobile and later use them to pay for public services, recharge cellular phones, and even pay for gas or buy at the local convenience stores. Tpaga’s mobile wallet is just another sample of financial inclusion initiative, as the solution has given access to finance to underbanked and provided an easy solution to enter digital financial services.

Pioneer electronic deposits provider Movii allows its user to securely store money without any fees involved through their mobile app. Users acquire the complimentary debit card powered by MasterCard for COP $10,000 pesos (nowadays [Apr. 2020] less than USD $3 dollars) which can be used online for purchases and worldwide at any point of sale terminal. Additionally, users can also pay public services and connect to other services with discounts via Movii‘s app. Movii has also taken the lead in confronting local banks upfront for their various handling plus hidden fees for every product, for the irregular access for citizens, and poor levels of customer service. Bringing the population closer to their money through tech, Movii aims at allowing citizens to move money freely and also save without incurring in so many detrimental fees. It also points to diminishing the affluent use of cash by giving its users immediate access to electronic transactions. FinTech Finaktiva provides much-needed capital to SMEs, entrepreneurs, and founders based on their own innovative model to help small ventures grow. Finaktiva, through its unique organization also provides capital to micro agro-ventures, a great way to contribute to local development and help advance financial access across the wide and unprovided Colombian countryside. The financial technology sector in Colombia holds an essential role to play regarding access to finance and inclusion. The segment continues to push boundaries providing digital solutions for financial services and representing a local leadership force in this new era. According to the IADB, FinTech solutions and digital financial services offer a unique opportunity to serve previously underbanked individuals and SMEs in Latin America. In Colombia, the possibilities are set to nurture collaboration between players in the local environment in order to close financial inclusion gaps while promoting responsible financial practices.